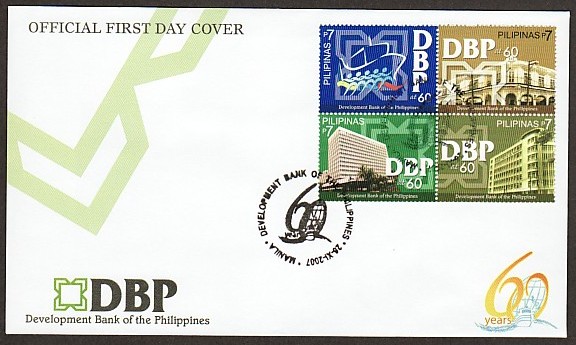

2007, November 26. Development Bank of the Philippines (DBP) - 60th Anniversary

Litho Offset. Amstar Company, Inc. Perf. 14

Se-tenant Blocks of 4, Miniature Sheets of Sixteen (4 x 4), Souvenir Sheets of 4

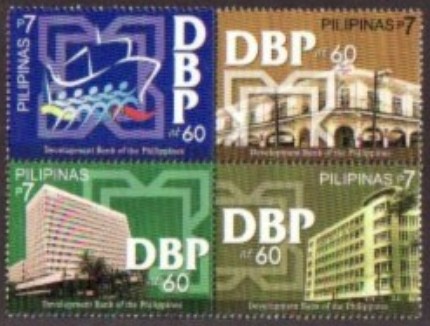

Se-tenant Blocks of Four (50,000)

7p Stylized Ship and People

7p DBP Building 1

7p DBP Building 2

7p DBP Building 3

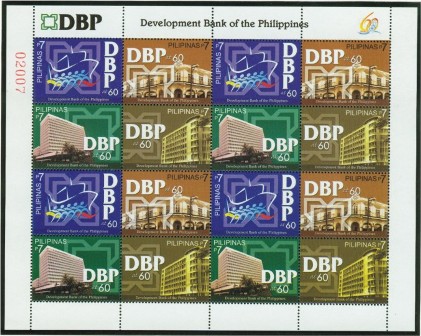

Miniature Sheets of 16 (12,500)

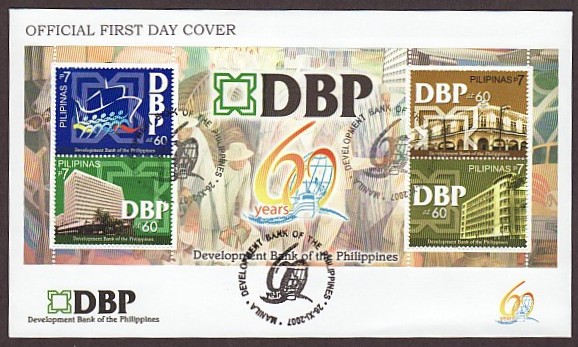

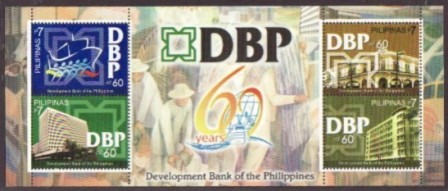

28p Souvenir Sheets of 4 (10,000)

Graphic Designer: Rolando Carcamo

First Day Covers: Manila

DEVELOPMENT BANK OF THE PHILIPPINES - 60th ANNIVERSARY

Development Bank of the Philippines history can be traced back to the Commonwealth years when the early infrastructure for development financing was laid down by the government.

In 1935, the National Loan and Investment Board (NUB) was created to coordinate and manage government trust funds such as the Postal Savings Fund and the Teachers' Retirement Fund.

In 1939, the Agricultural and Industrial Bank (AIB), which absorbed the functions of the NUB, was created and started to harness government resources until the outbreak of war.

On January 2, 1947, the government created the Rehabilitation Finance Corporation (RFC) under R.A. No. 85 which absorbed the assets and took over the functions of the AIB. The RFC provided credit facilities for the development of agriculture, commerce and industry and the reconstruction of properties damaged by the war.

In 1958, the RFC was reorganized into the Development Bank of the Philippines. With an initial capital of P500 Million subscribed by the government, DBP expanded its facilities and operations to accelerate national development efforts.

DBP delivered to the economy substantial benefits in capital formation, employment generation and increased revenues, particularly in the countryside. In the late seventies and early eighties, however, its viability was undermined by an increasing number of non-performing accounts following a period of economic difficulty.

The Development Bank of the Philippines, under its new charter, is classified as a development bank and may perform all other functions of an expanded commercial bank. Its primary objective is to provide banking services principally to cater to the medium- and long-term needs of agricultural and industrial enterprises with emphasis on small-and medium-scale industries.

DBP also undertakes continuous institutional strengthening efforts to ensure its viability and strategic positioning towards globally competitive operations

-

Banking